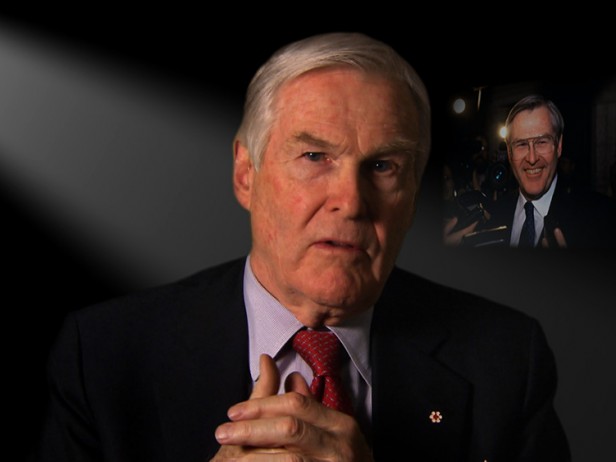

Michael Wilson PC OC is a former Minister of Finance (1984-1991) in the government of Brian Mulroney; a former Canadian Ambassador to the United States (2006 to 2009); and the time of the interview was Chairman of Barclay’s Capital Canada Inc. He is Chancellor of the University of Toronto and is active in more than a dozen professional and community associations.

Michael Wilson PC OC is a former Minister of Finance (1984-1991) in the government of Brian Mulroney; a former Canadian Ambassador to the United States (2006 to 2009); and the time of the interview was Chairman of Barclay’s Capital Canada Inc. He is Chancellor of the University of Toronto and is active in more than a dozen professional and community associations.

BENGER: Part of the role of this documentary is to try to define tax avoidance. Do you want to make some points about that?

WILSON: I think it is important to distinguish between tax incentives and tax expenditures, as we call them, or tax preferences. These are things that are put into the Tax Act to encourage people to do things. Now, we take advantage of these on a regular basis. RRSPs are a tax expenditure, or a tax incentive to save more. These are good things.

Then you get more into the more aggressive side of how you utilize these things and that’s where you get into the area of tax avoidance. And some little rules of thumb that I think we have to think about is that if there is a commercial reason for doing something, utilizing the Tax Act, and it is consistent with what the tax authorities expect people to use that tax provision for, that’s okay.

Something that is totally tax driven gets over into that margin of tax avoidance and I think that that is the… If there’s a commercial reason, then that’s a pretty solid basis for utilizing the Tax Act to do whatever that commercial act is.

BENGER: I think Canadians understand you need some tax breaks to survive in business.

WILSON: Sometimes those are described as tax avoidance. When they are legitimately in the tax system, the Tax Act, to encourage things. But they get lumped into tax avoidance because there’s a significant amount of money that is lost from the system if those tax preferences that as tax incentives weren’t in place.

And this is where, with respect, the media sometimes slips more into the tax avoidance area in an inappropriate way.

BENGER: This story started for me with how the UK Starbucks was arranging its affairs so that it paid no tax. How many Canadian companies routinely do that?

WILSON: I would expect that a number of the Canadian companies do that and I think the… what if I were the tax director or the CFO in a firm, I would be saying, “Are we going too far in this?” because in a global community and a global world, it is easy to go from jurisdiction to jurisdiction — tax shopping if you will — to find a combination that is right.

And that’s where my point about is it, are you going past what the Tax Authorities think you should be doing? And that I think is a question that should be asked.

BENGER: As a former federal politician and a creature of Bay Street, what do you think is the line not to be crossed in terms of public responsibility? How do you balance profit and social responsibility?

WILSON: I think… it’s a hard line to draw. It’s not a sharp line in the sand or anything like that. You get into a grey area when, by taking advantage of moving this money around, you leave the tax payments that you make in a certain jurisdiction way below the normal tax rate. Taking them below the normal tax rate, the basic tax rate so to speak, is not illegitimate.

But if you get way below that, then you run into an area where you’re going to be challenged, and it may be challenged by the Tax Authorities who want to question just the legitimacy of what you have, what you are doing, or you get into the media as companies have in certain countries, where they’ve been on page one of the local papers saying they’re doing all this business in the country and hardly paying any tax at all.

And then the line, the line that you’re crossing is a reputational line. Is this company going so far to take advantage of the tax system that they’re not paying anything for the benefits that they gain of working and running their business in this country? And that is judgmental, just how far they should go, but I think it’s something that boards of directors should be asking the question of their tax people.

The tax people are paid to find out how they can run their business at the lowest reasonable tax rate. It’s when they cross that line as to what is reasonable and they get into that reputational territory, then that should be a red light or cautionary light for the directors to say, “Look, I think we’re going overboard here. We’re taking advantage of things that we probably shouldn’t be taking advantage of.”

BENGER: The tax office in Connecticut is considered to be the star tax lawyers in the world because they’ve reduce GE’s taxes to zero. How do you personally see the respect granted to tax lawyers who can reduce your taxes to zero?

WILSON: As I said, there’s, the legitimate responsibility of the tax people in the organization is to find ways that they can reduce their taxes, not crossing the line into evasion but reduce the taxes to the lowest possible point. My point is, or my comment was that if you go overboard on that, then you will draw attention to yourself. There may be reputational damage, you may attract a lot more attention from the Tax Authorities to go through with a fine tooth comb to find out whether what you’re doing is the right thing to do.

And that, again, it’s a grey area that you’re getting into. But I recall when I was in government as Minister of Finance, a friend of mine asked me to come out after Question Period, and he never looked me in the eye. He always moved around to be standing beside me. He was clearly not comfortable with what he was going to say. Then he said, “Get a piece of paper and a pencil,” and he said, “take down these three sections of the Act. They’re being used in a inappropriate way to reduce people’s taxes.” And I said, “Tax evasion?” And he said “No, it’s all in the Tax Act but they’ve found a way to combine these things in a way that was never intended and getting a very substantial reduction.”

The difficulty for us… I went back to my tax specialists, very good people, I told them this. It took them six months to find the problem, to realize what they were doing, and another six months to figure out how they could stop it. Because it was an inappropriate use of the tax system.

BENGER: What does that tell you about tax lawyers and the fact that you weren’t aware of this manipulation?

WILSON: I was not aware of that particular issue and I said to him, with a little smirk on my face, “I guess you’ve done a number of these things and you’re starting to feel a little embarrassed. So that’s why you’re telling me.” And he said, “M’hmm.” So he knew that they were going overboard, they knew that they were going further than they should.

WILSON: I was not aware of that particular issue and I said to him, with a little smirk on my face, “I guess you’ve done a number of these things and you’re starting to feel a little embarrassed. So that’s why you’re telling me.” And he said, “M’hmm.” So he knew that they were going overboard, they knew that they were going further than they should.

BENGER: Would this government have had to cut so many jobs if they had collected avoided corporate taxes?

WILSON: Well, you have to look at the other side of a tax expenditure, a tax incentive and see what sort of value in the economic activity that was encouraged, or that resulted from that tax benefit? All the tax benefits in the film industry have created jobs and they’ve been very useful in developing a cultural sector in this country, which we didn’t have before. So it’s not just the economic activity, it’s the cultural activity as well.

So you just can’t look at the raw number. Now, periodically, when I was in government we did it once. We had a… I jokingly called it an enema where we cleaned out the system of a number of tax expenditures that have outlived their usefulness. Or that people were taking undue advantage of and we weren’t getting sufficient benefit.

And we did this and saved a lot of money, and were able to reduce our overall tax rates. So we were able to save by eliminating tax expenditures, which are spending by another name, and in that way were able to reduce tax rates, improve our competitiveness as a country, because other countries had lower tax rates than us, and allow our companies to compete more effectively and also to attract investment into Canada. So there’s a lot of sides to that question.

BENGER: (reading quotation from Chrystia Freeland about the Starbucks story leading to howls of rage in the top executive suites against the backlash these revelations have provoked) What do you think their view is of the debate on this issue from the C-Level suite?

WILSON: Let me give you an example of my own bank, the bank where I work which is Barclays. Barclays had a significant business in this area of tax structured issues. And in the last year, year and a half we have reviewed a number of those practices and we said, “This is not a business we should be in.” We went too far. We looked at ourselves in the mirror and said, “We should be pulling back.”

These things, these deals are driven almost entirely by taxes, they’re not driven by the economic output or outcome that should be there. And if we didn’t have that very significant tax element to it, these deals wouldn’t be done. And we backed away from a lot of that business.

BENGER: Is there a chill on these tax management firms?

WILSON: I think other banks are doing the same things. I’m not privy to that, I don’t follow this that closely. But I’m just giving you an example that I’m directly familiar with in the bank where I work.

BENGER: The OECD’s hand’s seem to be tied due to the lobbies and corporate pressures to leave things alone.

WILSON: I think it is a fair point to make that if one country gets too tight in how they are going to manage this practice, then it could scare away business. And scaring away business means scaring away investment and jobs. So it is important, if it’s going to be done, that it be done on a broader basis than just one brave Minister of Finance saying, “This is what we’re going to do in this country because you may well live to regret it.”

BENGER: I asked Jim Flaherty about tax loop holes, and his reply was that he was not able to combat it. The tax lawyers still get around it. Is it possible that tax avoidance has slipped through the cracks, but that we will pay the price down the road for allowing the system to continue?

WILSON: First of all, if this becomes a significant issue that people, the average person grabs onto, there will be political pressures on how the government responds to this. So the, this film that you’re doing right now could be very helpful in raising the awareness.

We do have the Anti-Avoidance Rule. But let me just make a point that sometimes people lose sight of. I don’t know how many times I was criticized for the complexity of the Tax Act. And the reason why the Tax Act is so complex is that the Tax Authorities have to put in these very complicated responses to tax avoidance schemes. I gave you my example earlier where it took a while for our people to fix it and I’m sure that added to the complexity of the problem.

But this is, it is, it’s just a fact of life that we can’t get away from, when you have the complexity of the Tax Act that we have — and every country has it — because it results from the complexity of the industrial and commercial environment that we live in. And if we have that complexity, it is going to be easier for tax specialists to put Section 2A, little 3e together with two other provisions in the Tax Act to come up with some of avoidance scheme.

If the government feels that this is going too far, they do have the tools to go after it. And we’re continually, it wasn’t just Flaherty but Martin I’m sure and certainly I did, we’d go after as many of these things as we can, as we know of. But if we go overboard on that, the Tax system becomes an unworkable thing and people will just say, “I throw up my hands, we’re not going to do this, we’re not going to do that because, A, the uncertainty of what the outcome would be, or because it’s far to onerous and we’ll just forgo that bit of economic activity.”

BENGER: How does offshore banking fit into the view of the Finance Minister and a country’s economic picture?

WILSON: First of all, if it went to the Caymans and there was capital gains on those assets, then taxes would have been paid on the assets before they left the country. So that’s one thing that you shouldn’t lose sight of. The second is these people are sending money down there because they have a better way of investing that money. Whether they’re paying taxes on it I can’t comment on that. I just don’t know.

But most people have some money invested outside of Canada. A lot of people, a lot of that group would be paying taxes on the investment activity that they have. You’ve seen the activity between the Government of the United States and the Government of Switzerland where the Swiss were forced to give up the names of people who had secret accounts.

So it’s, if these monies are outside the country and the people are paying tax on them in Canada because they own the asset, then there’s not, it’s not an illegitimate thing. We encourage companies to invest money outside of Canada because it broadens their reach, it broadens their economic activity, and creates jobs in Canada — as well as creating jobs in these other countries.

BENGER: Theoretically the government would go after this massive pool of tax avoidance money to solve a national debt or deficit problem. But it looks like we’re going to have a balanced budget, so there’s no real incentive, from that point of view to go after any of this money.

WILSON: Oh yes, there is. There’s every reason for the Minister of Finance to go after this activity if is wrong activity. I mean that’s his job, to stop any activity which is wrong. One of the fundamental approaches of the current Conservative Government, and you hear it from other parties as well, is we’ve got to keep our tax rates down so that they’re competitive with the rest of the world.

And if we can find ways of getting our tax rates down, even with a surplus, we’re going to be doing the right thing for the country. Because if we don’t do that, we’ll be back in deficit quickly because people will… If we have our tax rates are too high in this country, business will leave, personal investment will leave, and we will have less economic activity here.

So I don’t buy the argument that moving into surplus takes this whole issue off the agenda.